An EV can change a life.

GoodWheels enables low-income families in the Washington, DC region to trade-in their gasoline vehicle for a refurbished Nissan Leaf EV that can save them $1,000 to $1,500 annually on fuel and maintenance. For many families, that's nearly enough to cover a month of rent and over time can break the paycheck-to-paycheck cycle that traps them at the bottom of the economic ladder.

An electric vehicle can save nearly $1,500 a year in fuel and maintenance - in many places that’s enough to cover a month of rent.

Less Fuel. More Food.

Because EVs are much more efficient at converting energy into motion, Consumer Reports estimates they can save drivers 60% on fuel costs compared to a similar gasoline-powered vehicle.

Take a Baltimore, Maryland resident commuting 30 miles round-trip each weekday and driving a 2011 sedan that averages 21 miles per gallon. Driving an EV would save them nearly $900 each year. For many low-income families, that’s like getting a free month of groceries every year.

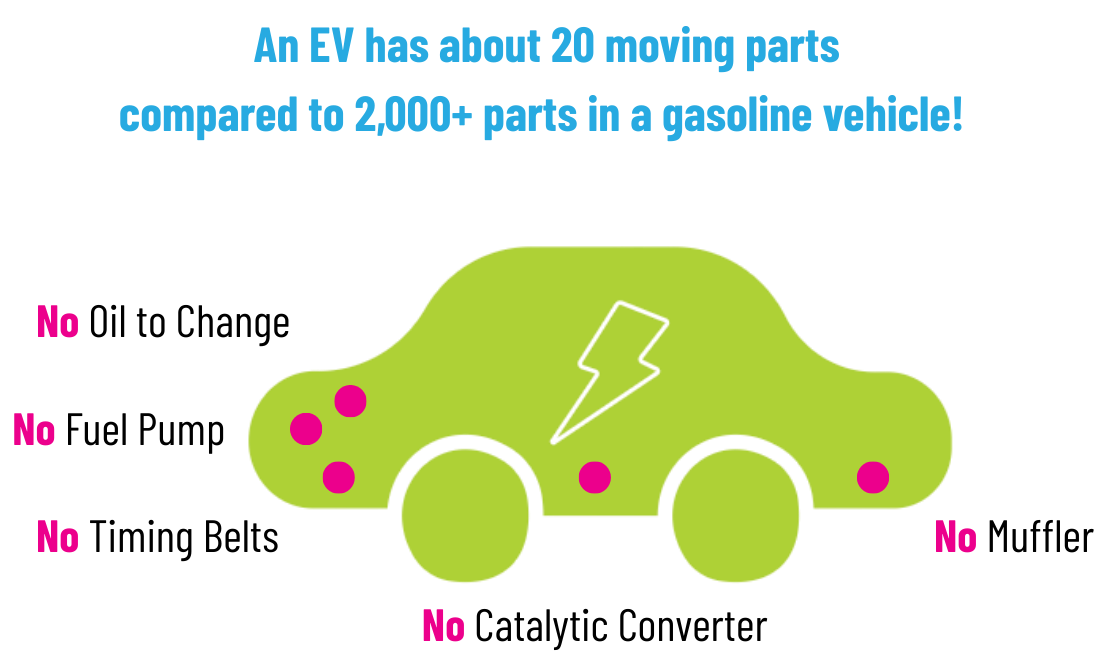

Fewer parts. Fewer bills.

With far fewer moving parts (about 20 compared to 2,000+) to maintain, Consumer Reports estimates that an EV can cut maintenance costs in half - no oil to change, no timing belts to replace, no failing fuel pump…on and on. Many drivers who have had their EVs for years say the only maintenance they’ve done is to replace the tires!

The Baltimore commuter mentioned earlier could save another $500 or more on maintenance by driving an EV.

“It would just help tremendously and alleviate a lot of stress and weight of your shoulders.”

— Krystal, 37 year-old single mother