The paradox of car ownership

For the more than 50 million low-income households in the U.S., cars are a lifeline. Researchers have consistently found that having a car leads to better economic outcomes - keeping a job, getting a better job, leaving a welfare program, moving to a better neighborhood and more. But for many low-income households, the costs that come with a car traps them at the bottom of the economic ladder.

“You need the car to pay the rest of the bills. You can’t go without the car.”

— Mike,

Stuck with a cheap, old car

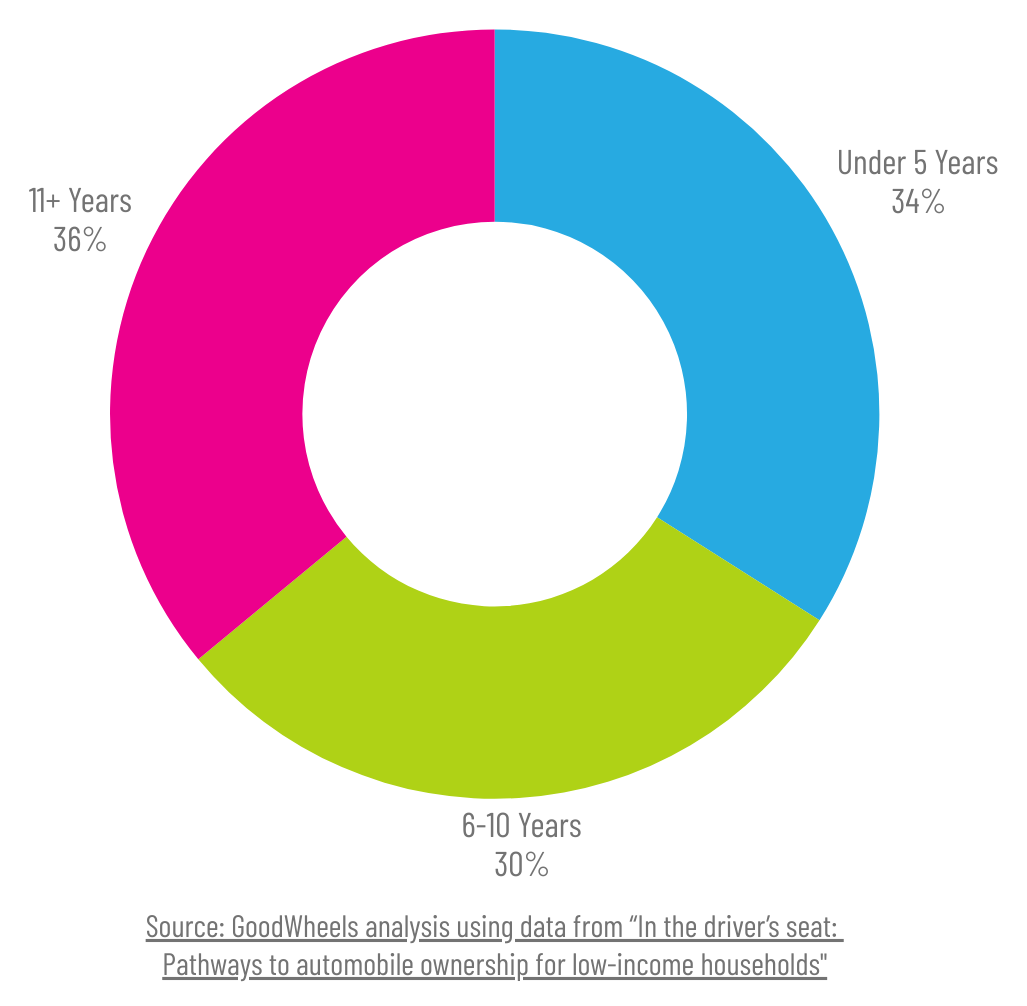

What’s behind this paradox? Too often low-income families are stuck driving old and unreliable gas-guzzlers that cost them more to fuel and maintain. Data from one study found that more than half of the low-income households who purchased a used vehicle spent less than $6,000. Not surprisingly, more than 1/3 of those households said their car was more than 10 years old when purchased, with another 30% being 6-10 years old when purchased.

“I live paycheck to paycheck…If I have to do something with my car, something else isn’t going to get paid.”

— Krystal, 37 year-old single mother

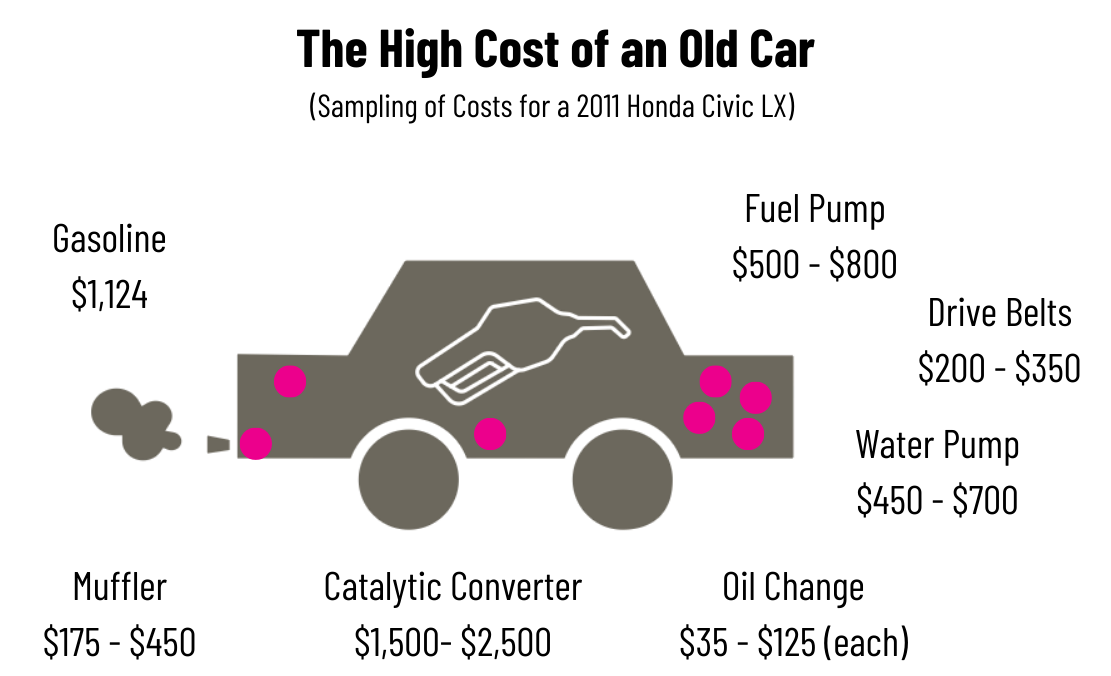

The high cost of an old car

The average car on U.S. roads today is 14 years old. At that age, maintenance and repairs can add up - oil changes, timing belts, a new muffler, or worse, a failing transmission or fuel pump. Based on estimates from AAA, the average household driving 10,000 miles each year would spend nearly $1,000 just on maintenance and repairs.

When you live paycheck to paycheck, these expenses can be a crushing financial burden. Among the bottom 40% of households in the U.S., those who own or lease at least one vehicle spend 30% of their income on transportation - that’s on par with the cost of housing and 2.5x more than the wealthiest households.